The Canadian Radio-television and Telecommunications Commission (CRTC) published a response to Telus’ request to add a credit card processing fee, saying it will make a decision within 45 business days.

Moreover, the CRTC said it will not approve the request “on an interim basis on the 15th calendar day following receipt” due to the “many interventions opposing this application.”

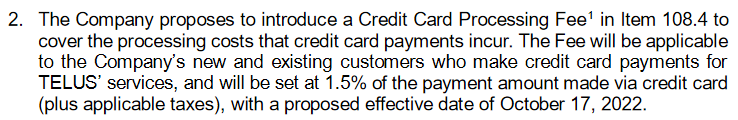

On August 9th, MobileSyrup reported on Telus’ request to the CRTC to add a credit card processing fee to customers’ bills. The fee would apply to customers who pay via credit card, and would be set at 1.5 percent of the payment amount plus applicable taxes.

In its request, Telus cited a lawsuit against credit card companies like Visa and Mastercard — the lawsuit will enable businesses to pass along credit card fees to customers starting in October. As a brief refresher, credit card companies previously charged businesses what are called interchange fees on purchases made using credit cards and had rules preventing businesses that accepted credit cards from passing the fees onto customers. Interchange fees range between one and three percent and often fund credit card rewards like cashback or loyalty points.

A settlement reached by the lawsuit would allow businesses to get a rebate on these fees as well as strike down the rules preventing businesses from passing on the fees to customers. While it remains unclear how many businesses will go through with passing fees to customers, Telus’ request to the CRTC to add a credit card processing fee upset Canadians, sparking a significant response from the public on the application.

The CRTC’s interventions page for the Telus request, which includes public comments and other responses, lists over 2,601 entries at the time of writing. Many of those entries include complaints about the high costs of wireless and internet bills in Canada, while others take aim at the federal government and CRTC for failing to protect Canadians from telecom companies.

Those who want to lend their voice can file interventions by heading to this link and then clicking the blue ‘Submit’ button next to the request. If you want to learn more about the lawsuit, check out the MobileSyrup explainer available here.

Source: CRTC