A study prepared for the Government of Canada found national flanker brands are charging more for wireless services in some cases than regional providers.

The study also found a similar difference in prices for wholesale-based competitors and regional companies providing mobile internet services.

The study, commissioned every year for Innovation, Science and Economic Development Canada, examines the three categories over “service baskets” or levels. Each category has a different number of baskets that reflects service volumes that capture usage levels by Canadians.

Mobile wireless

The study examined wireless services on eight different levels. Level one included voice minutes and texts. Level 2 only involves 1GB of data. Levels three to eight include unlimited talk and text, with varying amounts of data.

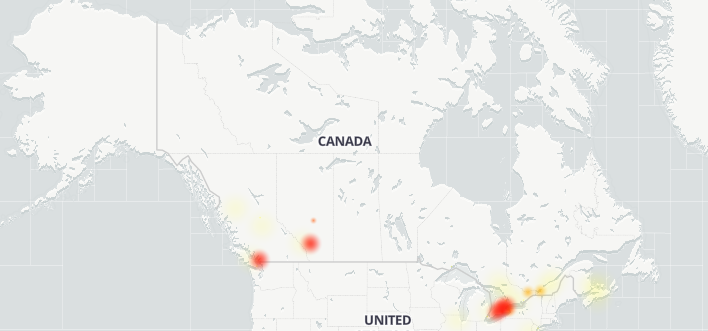

The comparison found prices offered by regional providers, including Freedom, SaskTel, Xplore Mobile, Videotron, and Eastlink, are between 6 and 22 percent lower than national incumbents, including Bell and Telus. Prices mostly greatly contrasted between incumbents and regional providers in Ontario and BC, where Freedom offers services.

The study also found that incumbents that offered flanker brands (Virgin, Fido, and Koodo) didn’t always provide the lower cost. “Flankers were higher priced 15 times and lower-priced 13 times. We do note that regional provider prices were consistently lower than flanker prices in Ontario and BC.”

Reseller plans that offer the same service levels as national providers were consistently priced lower. Most regions examined in the study also had a service provider or reseller available that charged less for specific levels than national providers.

Internationally, Canada, the U.S., and Japan have the highest wireless prices. The analysis found Japan charged more for all levels than Canada, except for Level 8, which features unlimited talk and text and between 20 and 49GB of data.

Fixed broadband internet

The study broke download speeds into seven different levels. Level one involved speeds between 3 and 9Mbps. Level seven involves speeds greater than 500Mbps.

Where both parties offer plans, incumbents offer higher prices than wholesale-based competitors (WBC) on four levels, all on the lower end of speeds. WBC plans are priced 8 to 18 percent lower. But the opposite is true for services with faster speeds. WBC plans cost 15 percent more than the incumbent.

Overall, Canada has higher prices on most levels than the U.S. Canada also saw higher prices in 2021 compared to 2020 on almost all levels. Comparatively, prices in the U.S. have been declining over the last couple of years. Compared to Japan, Canada has higher prices on the three lower levels.

Mobile internet

The study includes four levels: level one includes mobile plans with 2 to 4GB of data a month, level two includes 5 to 10GB of data, level three has 11 to 49GB, and level four includes plans with 50 to 99GB of data.

The study found regional providers are charging 25 percent less than incumbent providers for level one in all provinces except Quebec. For level two it’s 21 percent less, level three is 18 percent less, and level four is 37 percent less, respectively. Regional providers are uniformly charging more for mobile data than incumbents in Quebec.

Image credit: Shutterstock

Source: Innovation, Science and Economic Development Canada