It’s no secret Canadians pay some of the highest cell phone bills in the world.

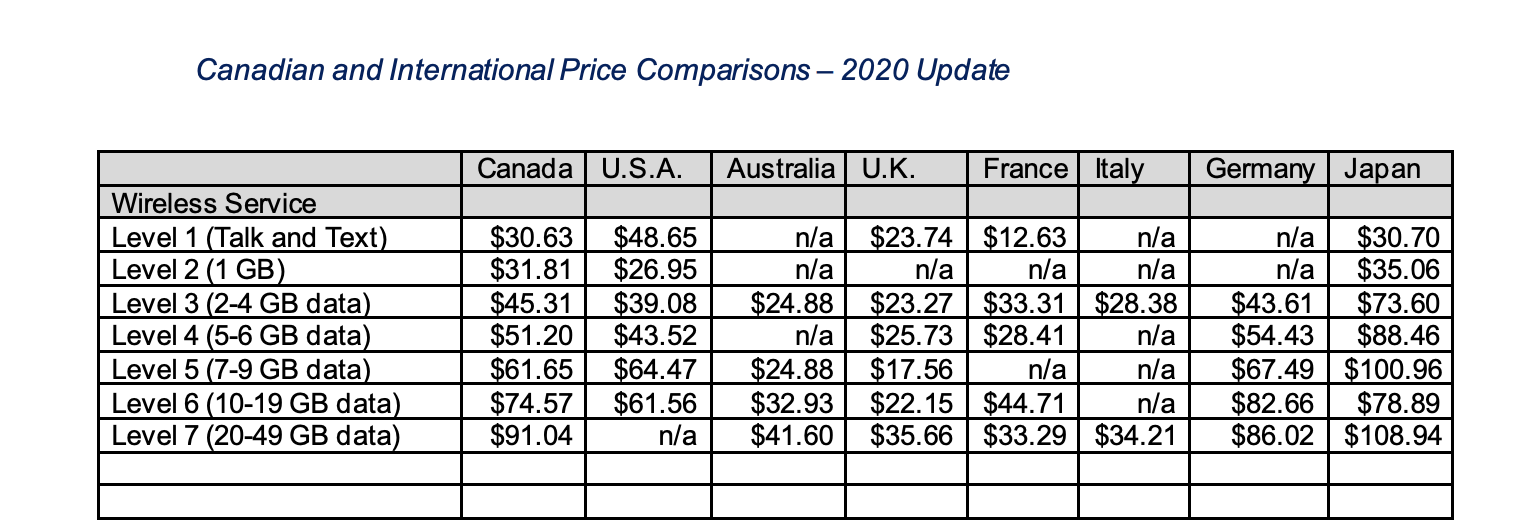

A report submitted to Innovation, Science, and Economic Development Canada examining the costs of wireless services in 2020 showed Canada offered some of the steepest price tags, coming in second to Japan.

Data is collected and compared for Canada, the U.S, Australia, the U.K, France, Italy, Germany and Japan. Level 1 refers to plans with 450 minutes of talk and 300 text only. Level 2 refers to 1GB of data a month and doesn’t include talk or text. The remaining levels include unlimited talk and text with specific data limits. All figures are in Canadian dollars.

In 2020, Canadians using plans with 2-4GB of data and unlimited talk and text were paying 64 percent more than those in the U.K using the same plan.

For years Canadians have asked for change. A recent survey by Ipsos shows that ask has not waivered.

The market research company surveyed 1,001 Canadians over 18 on how they felt about competition in various Canadian markets.

88 percent of survey respondents want more competition across several sectors because they believe it’s too easy for big businesses to take advantage of Canadians.

90 percent of the respondents said steps need to be taken so smaller businesses can compete with more prominent players and create more choices for Canadians, leading to lower prices, better quality products, and more innovation.

The telecommunications and cable industries need the most competition, with 72 percent of the vote.

The results aren’t surprising given the lack of competition in Canada. According to the 2020 Communications Market Report from the Canadian Radio-television and Telecommunications Commission (CRTC), Bell, Telus, and Rogers (known as the Big Three) represented almost 90 percent of mobile phone revenues in 2020.

The Big Three are continuing a historical trend. They appear in this category for results released in 2017, 2018 and 2019.

Only 28 percent of respondents say there’s enough competition in the telecom and cable sectors.

Source: Ipsos